One of the most significant factors for successful crypto trading is self-control. However, even professional crypto traders are not immune to mistakes. It’s not uncommon to see expert traders led by their emotions, making a wrong strategy. That, unfortunately, results in losses often caused by fear and greed, two very familiar words in the crypto trading sphere.

Fear and greed often change the course of a trade, causing negative consequences as a result of our unpredictable human nature. Nonetheless, it’s possible to reduce the losses which come from fear and greed in trading by understanding them and learning how to control our emotions.

To help traders locate one of the most consequential issues with trading, we are going to discuss fear and greed and the ways to avoid them.

Understanding Fear and Greed

People can often be irrational, and this applies to professional traders as well. Having a great strategy or experience in trading means nothing if traders are faced with a substantial rise in price on the market or the fear of missing out (FOMO). Take Bitcoin as an example. Would you be able to resist a sturdy price increase in a short period of time?

Traders are driven by the fear of not profiting when a price is dramatically rising, and greed correlated to the idea that others are using the opportunity to make higher profits.

To understand fear and greed as factors associated with crypto trading, it’s vital to know what they represent and what the basic concept is regarding these human emotions.

Fear

Fear is defined as an emotion, often caused by the anticipation of danger. However, in terms of crypto trading, fear can lead to many mistakes and miscalculations. For example, traders are more likely to sell coins before the prices rise high, and the bulls take over or miss out on an opportunity to invest in a certain cryptocurrency.

In other words, fear can lead to losses because of a weak and irrational decision or not having the patience to hold assets and sell them at a higher price.

Nevertheless, between the two, greed is a much more destructive emotion, particularly when it comes to trading.

Greed

Greed is interpreted as the desire to obtain more than you need out of something, usually related to money or, in this case, digital cash.

These two emotions are connected, and greed often arises from fear itself. In the crypto trading world, this is commonly referred to as FOMO and can be extremely harmful.

Traders led by FOMO usually buy coins at their highest, before the downtrend begins, and then refuse to sell them, which inevitably leads to losses.

Fear and Greed Index

Traders, as all human beings, are driven by emotions. So is there a way to control fear and greed in crypto trading?

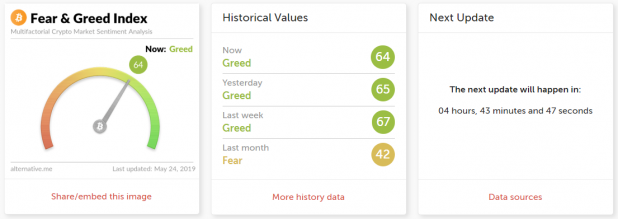

Some tools can help with this, such as the Crypto Fear & Greed Index, which measures many factors on the crypto market, including volatility, the market cap of major cryptocurrencies, the market’s volume, and even Google Trends data.

The tool provides traders with valuable info that can help them decide whether it’s the right time to buy and sell assets or not.

The Crypto Fear & Greed Index goes from 0 to 100, where 0 represents extreme fear, while 100 means absolute greed. Usually, although not entirely precise, when the index reaches 10-15, it indicates that a bull move might be on the way. Conversely, when the index reaches 65–100, there is a good chance of a likely price fall.

It’s difficult to say with 100 percent certainty that this indicator is effective, although it does provide valuable insight into the market’s movements and a representation of the traders’ current attitude.

Overall, traders should not entirely rely on the index, but it can serve as a helpful tool when in doubt.

Fear and Greed Biases

Every crypto trade goes through several major stages, and all traders, including experts, have faced them at least once. The steps include the following:

- Social proof

- Authority

- Inaction inertia

- FOMO

- Confirmation bias

- Loss aversion

Repeat.

Overall, it’s important to understand that sometimes it’s impossible to avoid fear and greed, considering that these are emotions that all human beings face. Traders are likely to make mistakes and lose profits.

In these situations, the most suitable solution for traders is to design a trading strategy and to not let emotions take over. In other words, stick to the plan despite what others might be doing.

Fighting with Fear and Greed like a Pro

Another way to avoid emotions is to switch to automated platforms for crypto trading, such as Superorder. Automated crypto trading terminals use strategy editors and trading bots to set up buy and sell actions, together with other possible indicators. Once the time is right, the systems start trading, discarding the fear and greed factor entirely.

Conclusively, what you can do is to admit your mistakes and embrace the fact that, despite a perfect strategy, some things cannot be avoided.

Finally, as a professional trader, understanding fear and greed is the first step towards improving your trading. Once you’ve included these two factors as a possible risk and worked towards a solution for resolving it, you are one step closer to maximizing your profits and upgrading your crypto trading strategies.